Table of contents

Other basic terms you should know

So, what is the relationship between bond prices and yields?

7 Factors that affect bond yields

Learn How to Trade with a Demo Account

What is a bond yield?

Bond

A bond is a fixed-income security that a corporation or government issues to raise capital. Investors can buy bonds, which pay them interest, to generate investment returns.

Yield

The yield is the return from an investment.

Bond yield

The bond yield refers to the return an investor receives from investing in bonds.

Other basic terms you should know

Issuer

The entity or organization that issues the bond to raise funds. It could be a government, corporation, or any other entity that needs to raise capital.

Bondholder

The investor who purchases the bond, hence lends money to the issuer.

Face value/Par value

The amount of money the issuer borrows and promises to repay the bondholder at maturity. It is also referred to as the principal amount.

Coupon rate

The interest rate paid on the bond, typically expressed as a percentage of the face value. This rate is fixed at the time of issuance and is paid periodically until the bond matures.

Maturity date

The date on which the issuer promises to repay the face value of the bond to the bondholder. It could be short-term (less than a year) or long-term (up to 30 years or more).

So, what is the relationship between bond prices and yields?

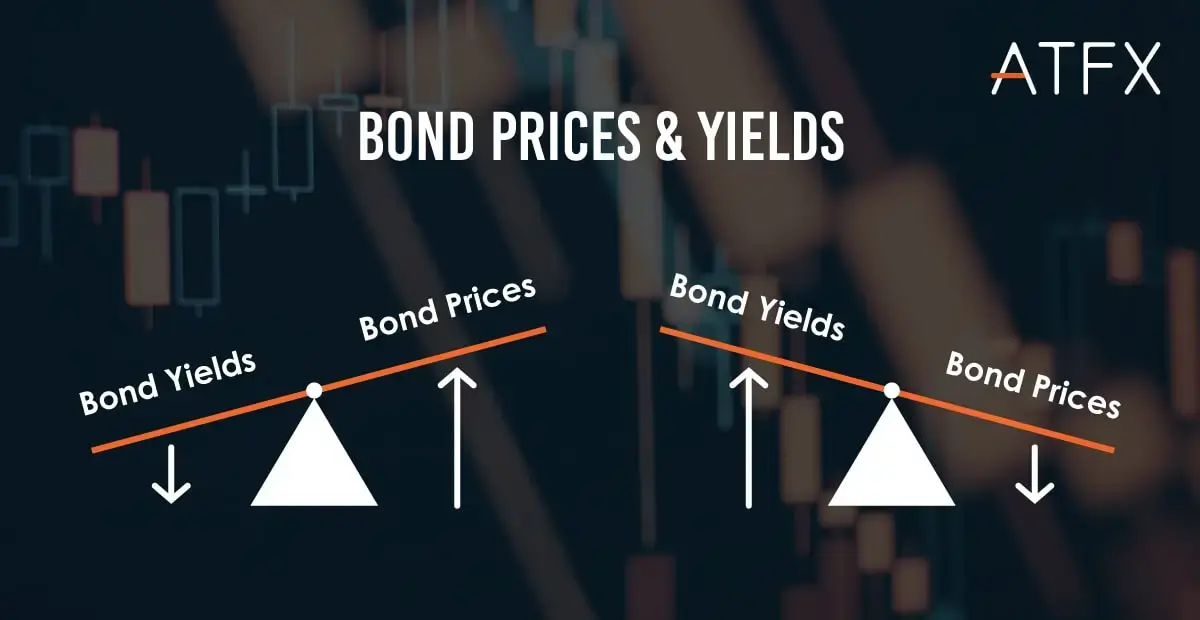

The relationship between bond price and yield is crucial but inverse. A lower bond price than the face value results in a higher bond yield than the coupon rate, while a higher bond price leads to a lower bond yield when compared to the coupon rate.

Therefore, the bond yield calculation depends on the bond price and the coupon rate. A decline in the bond price leads to an increase in the bond yield and an increase in the bond price results in a decline in the bond yield.

How to calculate bond yield

A bond is a loan to the bond issuer that allows investors to earn interest throughout its lifespan and receive the bond’s face value upon maturity. Bonds can be purchased at a premium or a discount, which alters the yield that an investor earns.

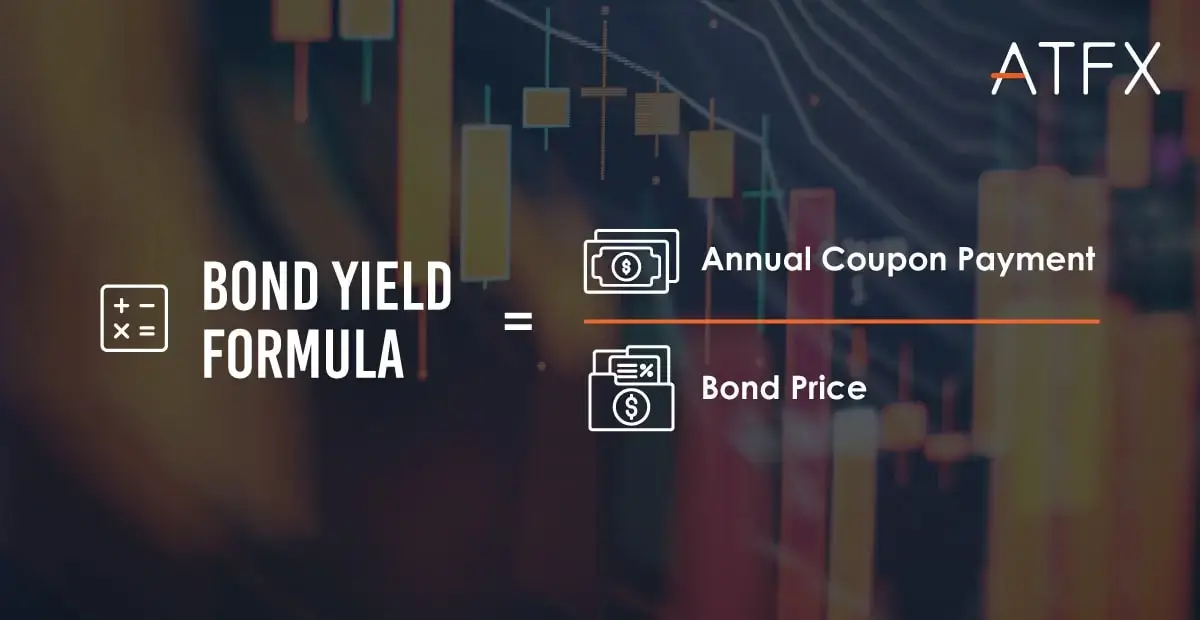

To calculate bond yield, you’ll need two figures: the bond’s annual coupon payment and its price. The coupon rate is the annual interest rate set at the time of purchase, and the annual coupon payment is calculated by adding up the yearly interest earned. The bond’s price is the current price. One simple way to calculate the bond yield is to divide its coupon payment by its face value.

However, this formula doesn’t factor in the time value of money, maturity value, or payment frequency, so it won’t provide an exact bond yield. Still, it can provide an estimate.

Bond ratings range from “AAA,” which signifies investment-grade bonds with low risk, to “D,” which denotes default or “junk” bonds with the highest risk. When a bond’s price changes, so does its yield. For example, suppose you bought a bond with a $1,000 par value and a 10% coupon, and the bond is selling for $800 in the market.

In that case, it’s selling below face value or at a discount. if you sell it for $800, the yield will be 12.5% ($100/$800). If you sell it for $1,200, the yield will be 8.33% ($100/$1,200). Regardless of the bond’s market price, the coupon remains the same. In the example mentioned, the bond holder would still receive $100 annually.

4 Main types of bond yields, with formulas & calculation

While the coupon rate and current yield are useful in estimating the return generated by a bond, they have limitations. They do not factor in the value of reinvested interest. They are inadequate when your bond is culled early or if you wish to evaluate the minimum yield possible.

To accurately evaluate these scenarios, more advanced yield calculations are necessary. so let’s look at the different types of yield.

Current Yield

Current yield, also referred to as the coupon rate, denotes the yearly interest rate that is fixed at the time of bond issuance and remains constant throughout the bond’s duration.

Current yield, is calculated by dividing a bond’s coupon yield by the current market price. As the bond’s current market price varies, the current yield will also fluctuate accordingly.Yield to Maturity (YTM)

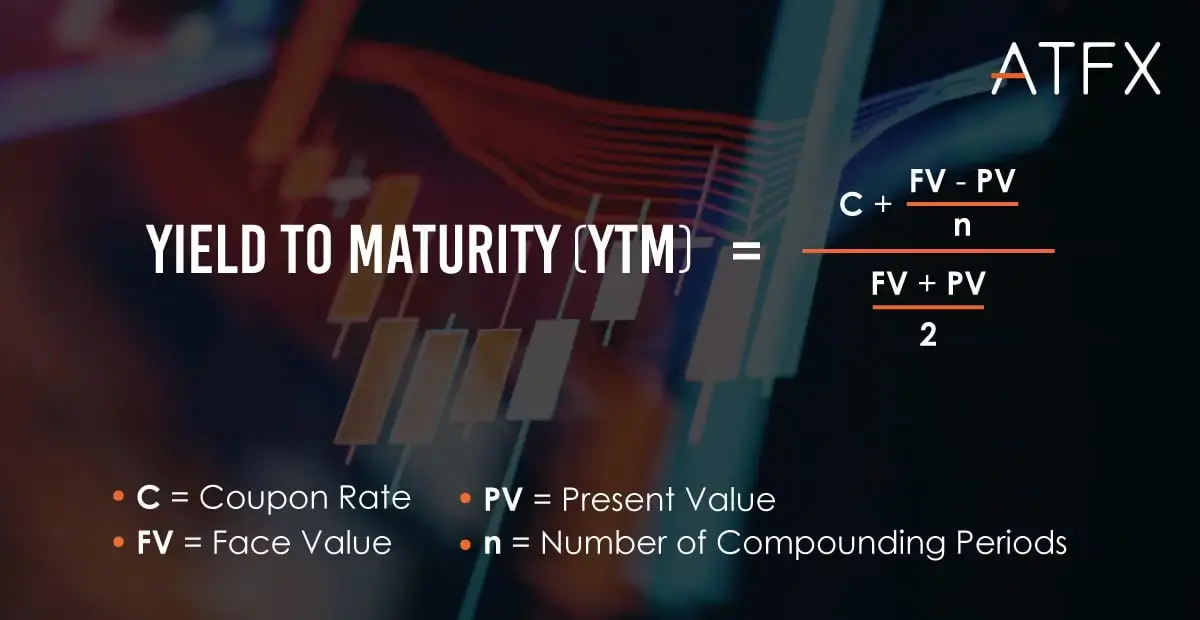

Yield to maturity (YTM) is an important metric for bond investors as it helps determine the overall interest rate earned by an investor who holds a bond until maturity. YTM is the discount rate that equates the present value of a bond’s future cash flows, including coupon payments and maturity value, to its current market price. This is a trial-and-error process that can be calculated using a financial calculator. Here is the formula for your reference:

For example, let’s say a bond has a par (face) value of $10,000, and you buy it at 90, that means that you will pay 90% of the face value, or $9,000. Let’s say it matures in 5 years.

The Bond’s current yield is 6.7% ($600 annual interest / $9,000 * 100).

Remember, the bond’s yield to maturity in this case is higher since it considers that you will earn compound interest by reinvesting the $600 you receive annually. The yield also assumes that once the bond matures, you will receive $10,000, which is $1,000 more than what you paid.

It is important to note that the YTM may differ from the bond’s coupon rate and assumes that coupon and principal payments are made on time. It does not consider taxes or brokerage fees associated with the purchase. Additionally, computations of YTM often assume that dividends are reinvested.

Despite its limitations, YTM is still a useful metric for bond investors as it helps compare different bonds and their potential returns.Yield to Call (YTC)

When investing in callable bonds, the Yield to Call (YTC) is a crucial measure to consider. Callable bonds allow the issuer to repay the bond early, which can affect the bond’s yield.

YTC is determined using the same calculation as YTM, but instead of using the maturity date, it employs the call date and call price, which must be calculated using the first date on which the issuer could call the bond.

Bonds have varying call dates and may continue paying interest at the appointed date until maturity, or only have an annual interest payment. If the bond price rises above par and trades at a premium, the chances of an early call may be higher. The issuer can then issue new bonds at a lower interest rate, although the early call price may also be at a premium under the original terms and conditions.

To calculate the potential return on callable bonds, investors must evaluate various yields to call and YTM. It’s also important to consider the range of returns available to gain a sense of what is feasible.

For example, Ridgeways Ltd, a property developer just issued a fixed-rate bond set to mature on December 31, 2025. The bond is currently trading at a $2.50 premium. Hence, the yield to maturity is 6.82% annually. However, it has two call dates, as shown in the table below.

Ridgeways Ltd fixed rate bond purchase price $102.5

| Date | Yield (p.a) | Description | Price Paid to investor |

| 31/12/2023 | 7.60% | First Call | $103.00 |

| 31/12/2024 | 7.07% | Second Call | $101.50 |

| 31/12/2025 | 6.82% | Maturity | $100 |

In this scenario, the yield to worst and the yield to maturity are both 6.82% per annum. Still, you should note that the bond yields vary as the price changes. For example, if the purchase price rose from $102.5 to $106, the yield would be different. In this case, the lowest possible return would be the yield to first call not the yield to maturity.

Ridgeways Ltd fixed rate bond purchased at $106

| Date | Yield (p.a.) | Description | Price paid to investor |

| 31/12/2023 | 5.76% | First call | $103.00 |

| 31/12/2024 | 5.80% | Second call | $101.50 |

| 31/12/2025 | 5.84% | Maturity | $100 |

4. Yield to Worst (YTW)

Yield to worst (YTW) is a measure of a bond’s lowest potential yield that considers both yield to maturity (YTM) and yield to call (YTC), with the lower of the two being used. This is important to know for every callable security, as it indicates the most conservative potential return a bond can provide.

However, YTM and YTC are only estimates and may not reflect a bond’s total return, which can only be accurately computed upon sale or maturity.

- Yield to worst is useful because it takes into account the possibility of the bond being called at the worst possible time for the investor, or not being called at all, which would result in a lower yield. This is particularly relevant since bonds are designed to offer downside protection to investors. YTW is the lowest yield an investor can expect if the issuer does not default.

- The YTW can be the same as YTC if the first call is the worst possible outcome for the investor, or the same as YTM if the investor is worst off when the bond is not called at all. If the issuer calls on the second or subsequent call date, the YTW could be lower than both YTC and YTM, resulting in the investor being worse off.

- If an investor purchases the USD Multisector fixed rate bond at $106.25, the yield to worst for an investor would occur if the issuer calls the bond at the first possible call date, since they will earn a 3.6% annual return. However, if the bond issuer does not repay it at the first call date, the investor has the opportunity to earn a higher yield. The best return an investor can earn on the bond is 6.33% per annum, if it reaches maturity. However, it is likely that the issuer will choose to repay the bond early and refinance it at a cheaper rate.

Multisector USD fixed rate bond

| Date | Yield (p.a) | Description | Price paid to investor |

| 30/06/2023 | 3.60% | First call | $104.19 |

| 30/06/2024 | 5.25% | Second call | $102.9 |

| 30/06/2025 | 5.61% | Third call | $100 |

| 30/06/2026 | 6.33% | Maturity | $100 |

When a bond is held until maturity without any calls and credit defaults, bond investing is relatively simple. However, it is crucial for investors to be aware of the quoted yield when buying or selling a bond, particularly regarding callable bonds and the yield to call (YTC).

7 Factors that affect bond yields

Interest Rates:

When the central bank reduces the base interest rate, bond yields also tend to decrease. People tend to search for alternative investments like government bonds due to lower interest rates on bank deposits.

Credit ratings:

Credit rating agencies, such as Moody’s, Standard and Poor’s, and Fitch, assign credit ratings to bond issuers and specific bonds to provide information about an issuer’s ability to make interest payments and repay the principal, capturing and categorizing credit risk.

Higher ratings generally indicate a greater likelihood of meeting payment obligations, and any changes in the ratings could impact bond prices. An improved rating leads to higher prices, while a reduced rating leads to lower prices.

Institutional investors in corporate bonds often supplement these central ratings with their own credit analysis, using traditional metrics such as interest-coverage ratios and capitalization ratios to assess credit risk. Issuers with a higher credit risk typically offer corporate bonds with higher interest rates to compensate for the added risk.Inflation:

Bond prices usually decrease when inflation is rising, and increase when it is decreasing. This is because inflation reduces the purchasing power of the returns on an investment. So, when a bond reaches maturity, the return earned on the investment will be worth less in today’s dollars due to inflation.

Time to Maturity:

Long-term bonds, with extended maturity dates, are more sensitive to interest rate changes than short-term bonds. If interest rates increase, long-term bond prices are likely to decline at a faster rate compared to short-term bonds. This phenomenon is known as the bond duration factor.

Supply and Demand:

There is an inverse relationship between bond yields and bond prices. When demand for bonds increases, causing their price to rise, the yield decreases. Conversely, when demand for bonds decreases and their price falls, interest rates and yields increase.

Economic Conditions:

When economic growth is strong, other forms of investment such as shares and private capital may become more attractive than bonds, leading to a decline in the demand for bonds. This results in an increase in bond yields, as bond issuers offer higher interest rates to attract investors.

Political and Geopolitical Events:

Events such as wars, political instability, and natural disasters can increase uncertainty and risk, leading to higher bond yields.

Why bond yield matters?

So, why should you care about bond yields? Bond yields are a crucial indicator of the strength of the stock market and the US Dollar’s interest level. If bond yields fall, it means bond prices are rising, indicating a surge in demand for bonds. Demand for bonds typically increases when stock investors become concerned about the safety of their stock investments and seek safer investments like bonds.

On the other hand, if bond yields increase, bond prices decrease, indicating a decline in bond demand. Demand for bonds typically decreases when bond investors feel investing in the stock market would be more profitable than investing in bonds, which can weaken the dollar.

Learn How to Trade with a Demo Account

If you wish to learn how to be an investor in the financial markets, we suggest you open a demo account. ATFX offers all the major financial products on a robust trading platform where you can practise different strategies while still learning from a guide or the free training materials ATFX provides. So, get your free demo trading account now!</p