The precious metal gold reclaimed its bullish momentum after testing three months low at $1800 last week. The recovery in gold witnessed during the Asian session today has been favoured by a softer US dollar dominance in the market ahead of the new week. The dollar index (DXY) seems to be consolidating below its all-time high at 105, and is unable to break above this point despite several attempts.

Gold recovery seems to be backed up by optimistic expectations of high data from the US retail sales report to be released tomorrow. The US retail sales report for April will be released this Tuesday.

This data undoubtedly significantly influences the US economy and determines the dollar strength in the forex market. The market expects the USD to gain further strength with higher retail sales figures and rising interest rates.

How does the retail sales report affect a country’s currency?

Regarding the US dollar, an increase in the retail sales report positively affects the greenback value. An increase in housing sales, for instance, shows the economy is growing as more people can purchase a house due to growth in the employment rate.

On the contrary, a lower retail trade balance will likely reduce the US dollar value.

What effect will the retail sales report have on gold?

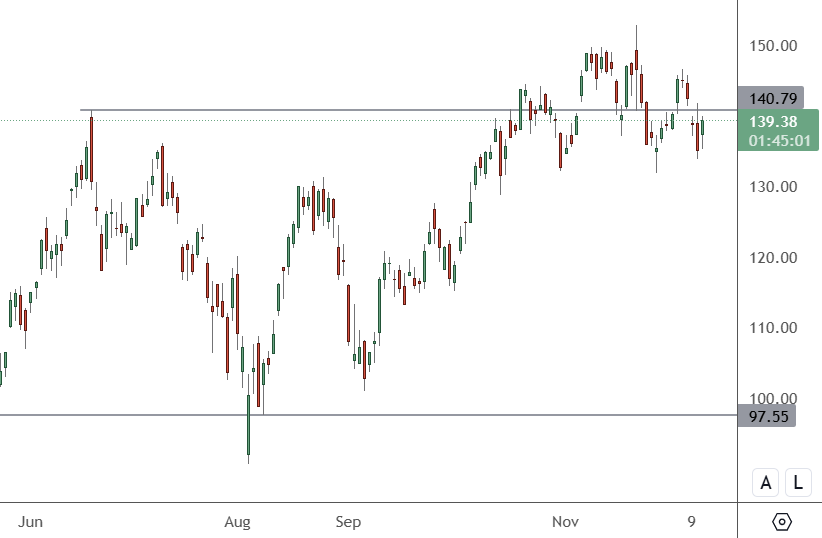

As expected, an increase in the retail sales data will strengthen the US dollar while hurting gold. If the data rises, gold might decline—below $1800 to the next support at $1767.

Nevertheless, suppose the retail sales data comes out lower. In that case, US dollar dominance would dwindle, favouring the precious metal gold. Therefore we might expect to see gold soar to the next resistance at $1835 and above it.

What is the forecast for the retail sales data tomorrow?

The retail sales data for April should come out higher at 0.7% than the prior print of 0.5% in March. Any figure below will weaken the increasing dollar strength and increase gold prices.